Build on a Solid Financial Future

AlumniFi has solutions to real-life financial needs to support you through each phase of your life.

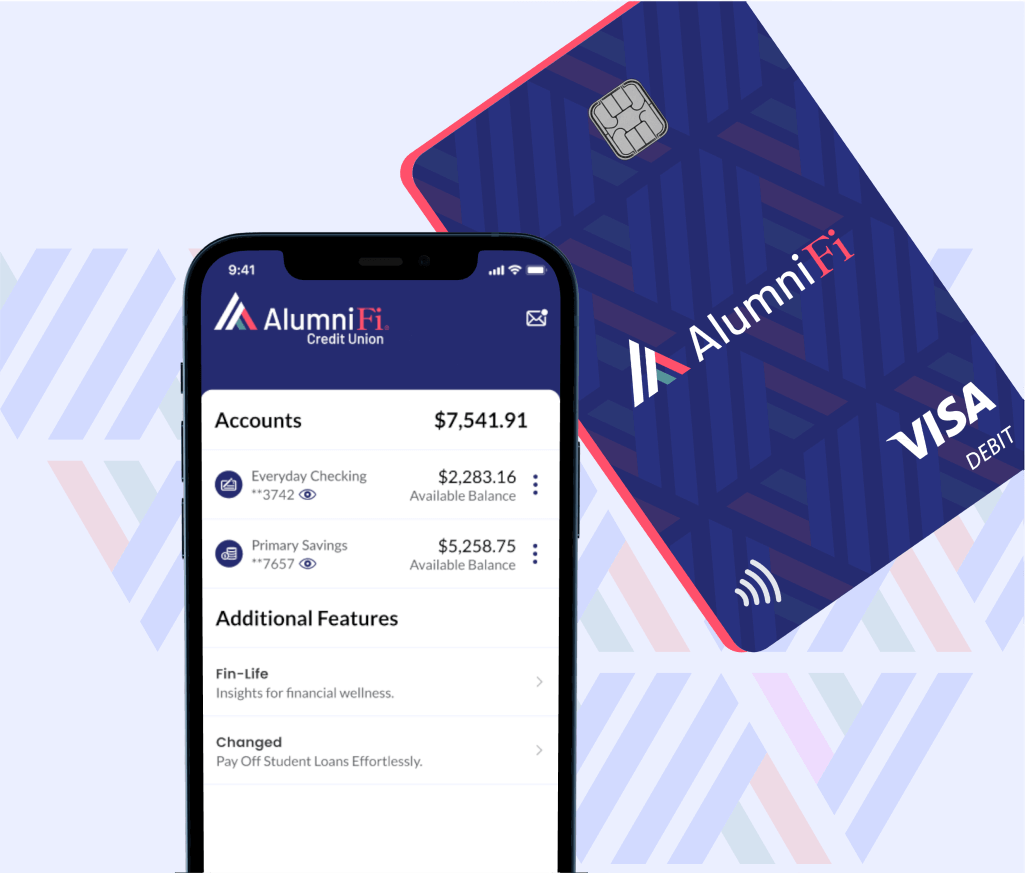

AlumniFi

CHECKING

A digital-first checking account with tools and features built for you.

- VISA Debit Card

- 30,000+ ATMs via the CO-OP Network

- Make transfers, pay bills

- Direct Deposit

- Spending insights

AlumniFi

SAVINGS

- Digital savings folders.

- Automated ways to save.

- No monthly maintenance fees.

- Free access to Changed, saving you $3 in service fees per month.

The Future Is Yours

Put yourself in control of your financial future with AlumniFi Checking and Savings accounts. Here’s how:

01

Fund your account and connect your finances into one digital dashboard: from checking to savings to loans.

02

Turn everyday spending into responsible spending when you track debit card purchases from your mobile app.

03

Put the extra where you need it most:

- Paying Off Debt

- Saving For A Rainy Day

- Securing Your Future Wealth

- Giving Back To A Cause You Care About

04

Automate your loan payments and track progress toward your debt-free day with access to Changed.

05

Find ways to make the most of your money with educational lessons and personalized insights.

There’s Always More to Learn

AlumniFi

3777 West Road

East Lansing, MI 48823

Contact Us

(855) 955-2965

Support

Member Support

Routing Number

072486898

Federally Insured by NCUA.

Copyright © 2025 AlumniFi, a trade name of Michigan State University Federal Credit Union. All rights reserved.

*Annual Percentage Yield (“APY”) means a percentage rate reflecting the total amount of dividends paid on an account, based on the dividend rate and the frequency of compounding for a 365-day period. This rate assumes that a set amount is on deposit at the beginning of the dividend period, no deposits or withdrawals are made during the dividend period, and funds remain on deposit for one full year at the same dividend rate. Fees may reduce earnings. Rates for accounts are variable and may change.

AlumniFi accounts are held at Michigan State University Federal Credit Union where savings are federally insured to at least $250,000 by the NCUA and backed by the full faith and credit of the United States Government. APR = Annual Percentage Rate. APY = Annual Percentage Yield. View our Privacy Notice and read our disclaimer regarding links to other sites via our Disclosures.

If you are using a screen reader or other auxiliary aid and are having trouble using this website, please call (855) 955-2965 for assistance. All products and services available on this website are available via our contact center.