Earn up to 4.00%APY* on SAVINGS

Make money moves all season long.

Score up to 20X the national average† on savings and experience banking built for Big East fans and alumni—powered by AlumniFi.

*APY=Annual Percentage Yield

†Competitor’s savings account with a 0.20% APY – $2,500 average based on the credit unions national average rate, as of 09/26/25, as reflected on NCUA Credit Union and Bank Rates.

Visa® debit card & easy ATM access

Bring your A-game to everyday spending.

†Competitor’s checking account with a 0.15% APY – $2,500 average based on the credit unions national average rate, as of 09/26/25, as reflected on NCUA Credit Union and Bank Rates.

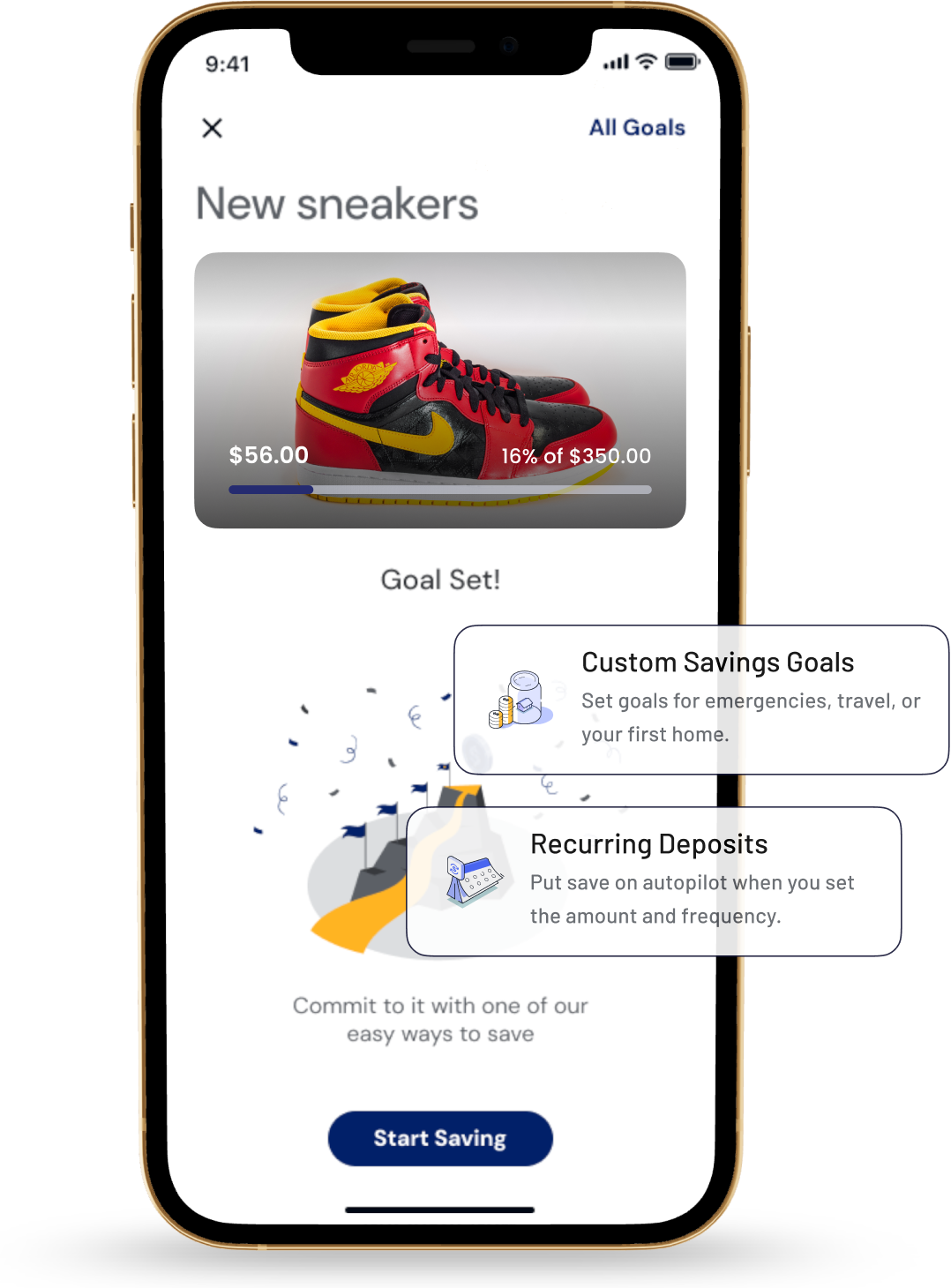

Custom Goals & Automated Transfers

Give your savings a home-court advantage.

Set goals for travel, sneakers, or whatever’s on your vision board. Automate your transfers and watch your savings score big.

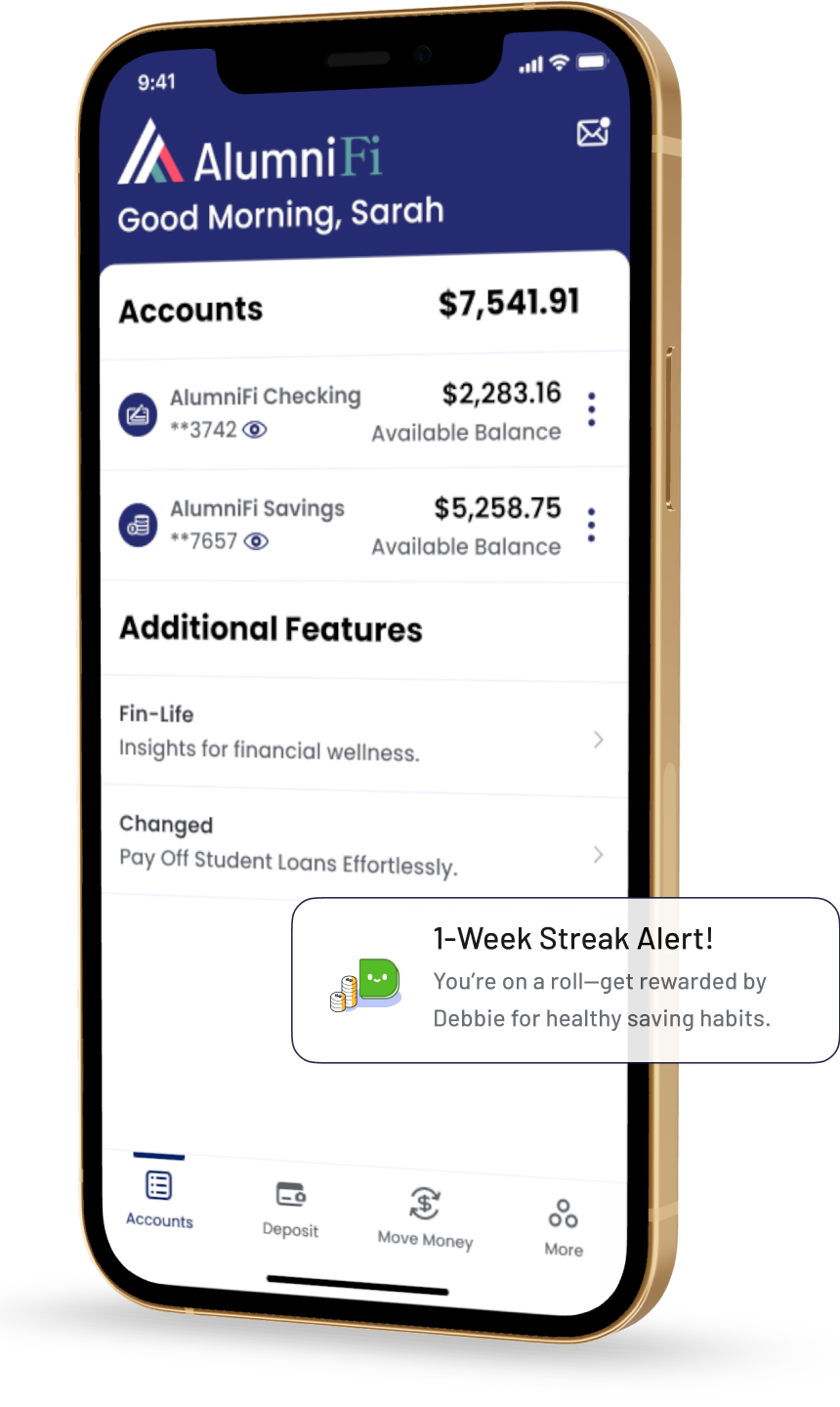

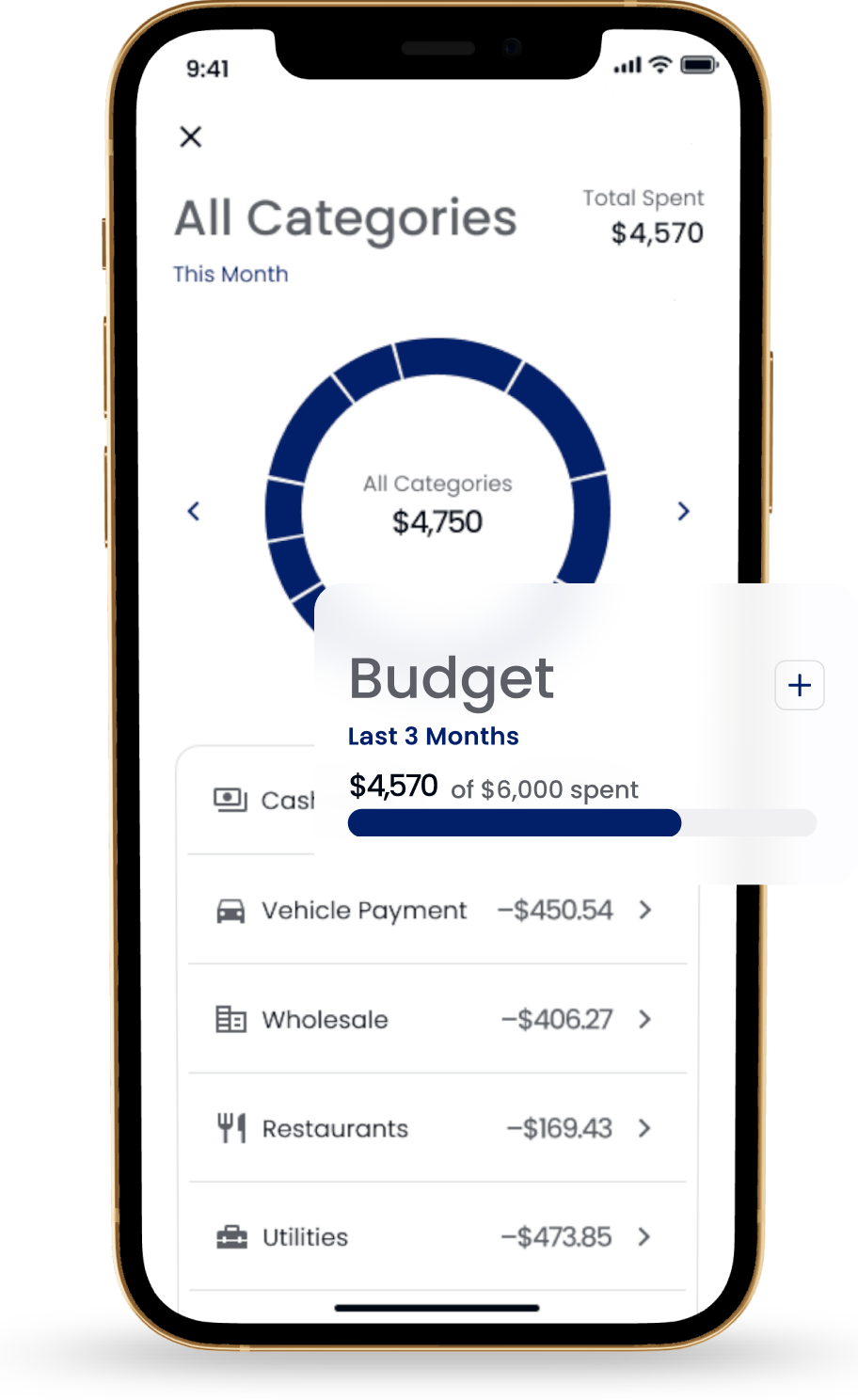

Everyday banking with champion perks.

AlumniFi makes it easy to spend, save, and get paid with smart tools that help your money go further.

Cash Rewards with Debbie

Get paid for building better money habits.

Debt Payoff with Changed

Round up spare change and watch loan balances drop.

Personalized plan with Fin-Life

Three minutes a week = a money strategy that actually fits your life.

Bank like it matters. Because it does.

AlumniFi is backed by the strength of MSU Federal Credit Union and federally insured by the NCUA—that’s banking built to keep you winning.

Read the full press release & learn more.

*APY=Annual Percentage Yield

†Competitor’s savings account with a 0.20% APY – $2,500 average based on the credit unions national average rate, as of 09/26/25, as reflected on NCUA Credit Union and Bank Rates.

†Competitor’s checking account with a 0.15% APY – $2,500 average based on the credit unions national average rate, as of 09/26/25, as reflected on NCUA Credit Union and Bank Rates.