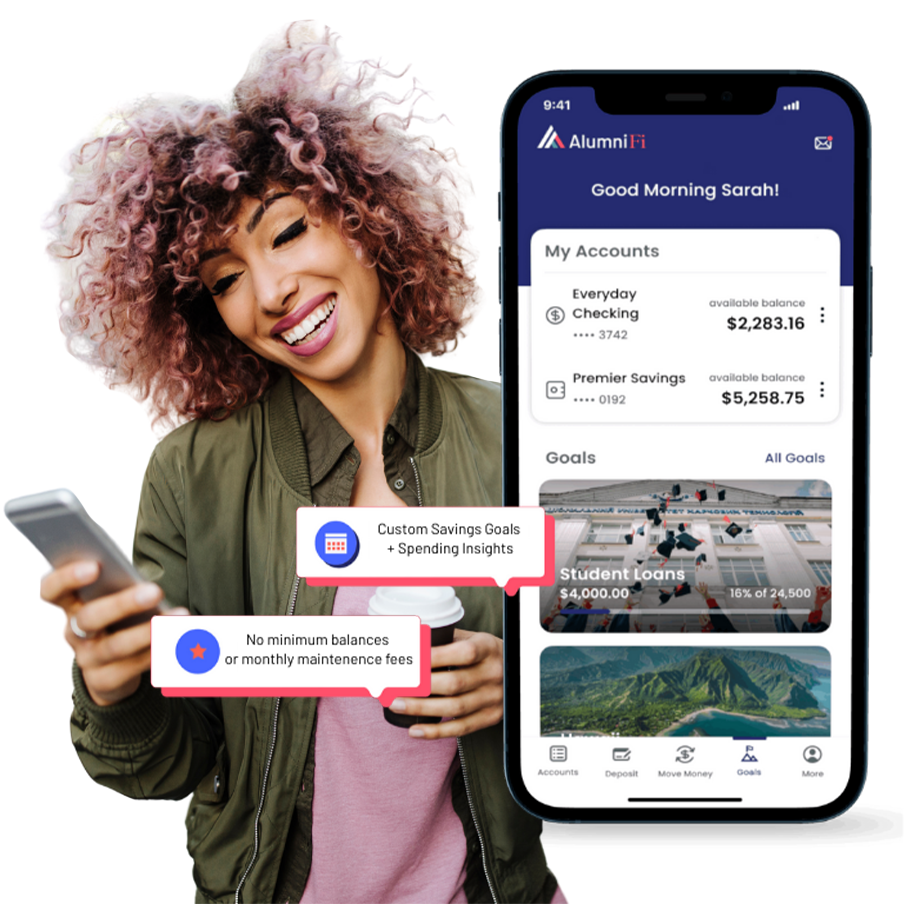

Welcome to AlumniFi. We’re happy you’re here.

Your Happy Money loan is powered by AlumniFi — a digital-first credit union built to help you save more, stress less, and grow your money with confidence. Now you’re officially part of a smarter, more rewarding way to bank.

Welcome to AlumniFi. We’re happy you’re here.

Your Happy Money loan is powered by AlumniFi — a digital-first credit union built to help you save more, stress less, and grow your money with confidence. Now you’re officially part of a smarter, more rewarding way to bank.

Adulting is Hard.

Banking Shouldn't Be.

Whether you're starting your career, building momentum toward new goals, or simply getting more intentional with your money, AlumniFi helps you manage your finances like a pro — without the stress.

• Free checking + no monthly fees

• 30,000+ surcharge-free ATMs

• Built-in insights to help you spend smarter

• Apple Pay®, Google Pay™, and tap-to-pay convenience

High-Yield Savings

That Works Harder.

Earn 23× the national average¹ with a high-yield savings

account designed to help you crush your financial goals faster.

Automated savings tools and customizable folders make it easy to build an emergency fund, plan for a big move, or start saving for your dream vacation.

Loan Payoff?

We've Got That.

Thanks to our partnership with Changed, paying down your debt is automatic — literally.

• Round up your purchases to the nearest dollar

• Apply the spare change to your loans

• Automate real progress—without lifting a finger

• Use the Changed App free with your AlumniFi account

Ready to Activate Your Full Banking Access?

You already have your AlumniFi membership.

Getting started is simple:

- Request to add a savings or checking account.

- Choose the tools and features you want.

- Start growing your money—and simplifying your finances.

Get Your Goals,

Take AlumniFi With You

Our resources are made to move wherever your

next step takes you. Download the mobile app today.

1Fine print: Competitor’s savings account with a 0.19% APY – $2,500 average based on the credit union national average rate, as of 06/27/25, as reflected on NCUA Credit Union and Bank Rates.