Official Financial Partner of

Cooley Law School Alumni

Official Financial Partner of

Cooley Law School Alumni

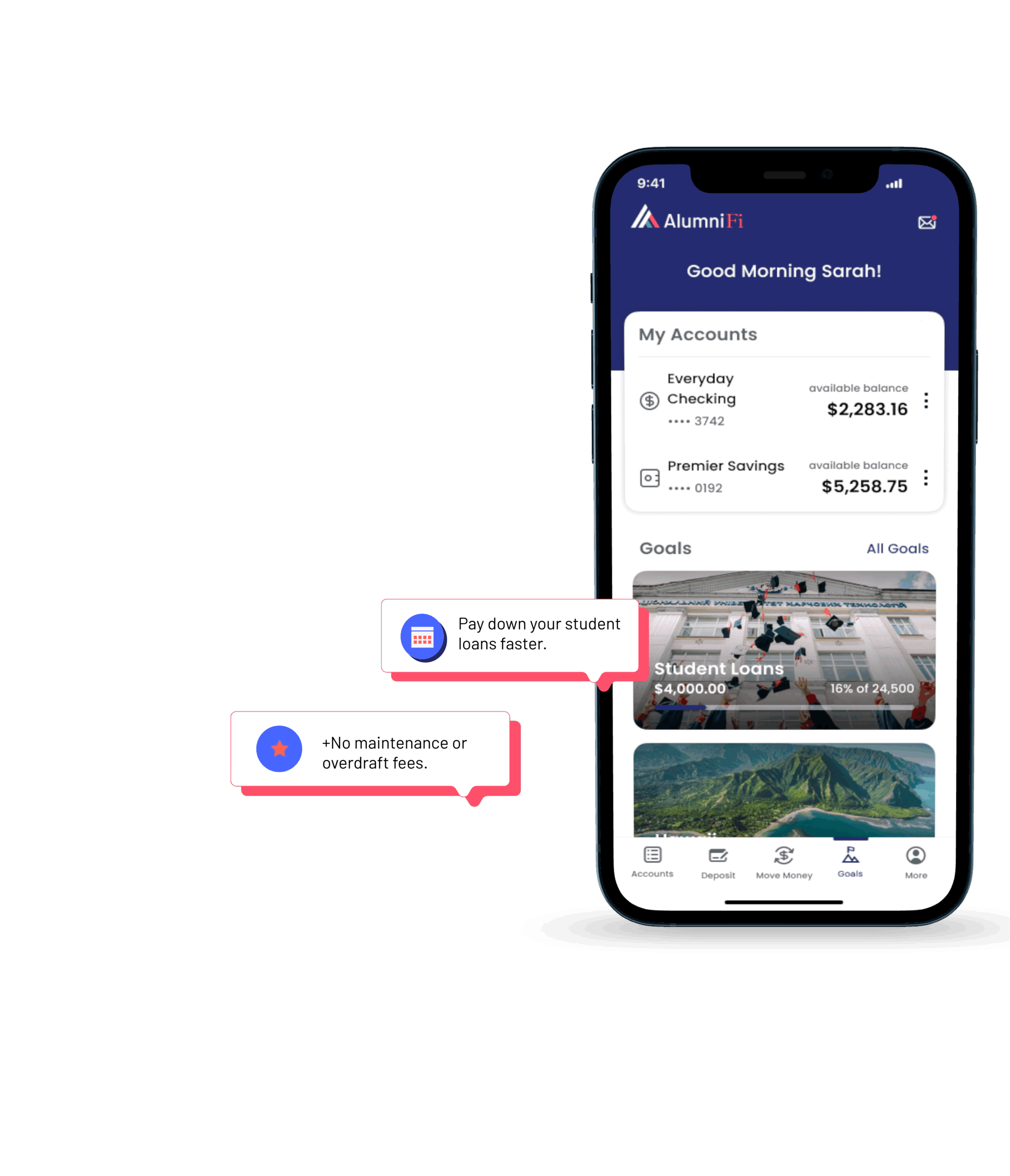

AlumniFi is your official financial partner, helping Cooley Law grads

manage student loans, save smarter, and build real financial freedom.

Adulting is Hard. Banking Shouldn't Be.

Whether you’re launching your legal career, starting your own firm, or making moves for what’s next, AlumniFi helps you handle money like a pro—without the stress.

- • Direct deposit + mobile check deposit = faster access to your funds

- • No monthly fees or minimums

- • 30,000+ surcharge-free Co-Op Network ATMs

- • Built-in insights to help you spend smarter

- • Visa® debit card with Apple Pay®, Google Pay™, and tap-to-pay

- • One simple app to manage your money, your way

High-Yield Savings That Works Harder

Earn 23× the national average¹ with a high-yield savings

account that helps you crush your savings goals faster.

With AlumniFi you get automated ways to save and custom savings folders —for bar loans, home down payments, and dream vacations.

Student Loan Payoff? We've Got That.

Thanks to our partnership with Changed, paying off your student loans is automatic—literally.

Crush your debt. Keeping living your life.

- • Round up your purchases to the nearest dollar

- • Apply the spare change to your student loans (or other debt)

- • Automate real progress—without lifting a finger

- • Use the Changed App FREE with your AlumniFi account

Get Your Goals

Download the AlumniFi app and start making progress today.

Post Law School Tools + Tips

AlumniFi isn’t just where your money lives—it’s where

your confidence grows. From student loan strategies to

life-after-law school checklists, we’ve got the tools you actually need.

Bank Like It Matters. Because It Does.

Open your AlumniFi account and start managing your

money your way—faster, smarter, and with less stress.

Open your AlumniFi account and start managing your money your way—

faster, smarter, and with less stress.

FAQs

- What’s AlumniFi?

AlumniFi is an all-in-one banking app built for life after law school. Whether you’re saving for something big, managing day-to-day spending, or paying off student loans, AlumniFi helps you stay in control—without the stress.With features like high-yield savings, built-in insights, and loan payoff tools powered by Changed, it’s smart, secure, and seriously easy to use.

Powered by MSU Federal Credit Union, AlumniFi brings you the tech-forward experience you want with the security you need.

- Why did Cooley partner with AlumniFi?

Cooley chose to partner with AlumniFi to support alumni as they move into the next chapter—whether that’s paying off student loans, saving for big goals, or just trying to stay financially confident in the real world.AlumniFi offers digital banking tools, financial education, and resources designed to help Cooley grads thrive now and in the future.

- Is AlumniFi secure?

AlumniFi accounts are held at Michigan State University Federal Credit Union, where savings are federally insured to at least $250,000 by the NCUA and backed by the full faith and credit of the United States Government. Your money is safe, and your data is protected. - I don’t live in Michigan or Florida—can I still use AlumniFi?

Absolutely. AlumniFi is built for wherever you are now—and wherever you’re headed next. It’s all online, all the time. - What if I need cash?

Need to grab some cash? No problem. As an AlumniFi member, you have access to more than 30,000 surcharge-free ATMs across the country through the CO-OP Network. That means you can skip the fees and find a nearby ATM—whether you’re on campus, out of state, or visiting home.

Here’s how to find one:

- Use the CO-OP ATM Locator online

- Call 1-888-SITECOOP (748-3266)

- Or text your location (like an address or zip code) to 91989 and get the nearest options sent to your phone

You can also look for the CO-OP ATM logo next time you’re out and about—it’s your shortcut to fee-free access.

- What’s a credit union, and how is it different?

A credit union is a not-for-profit financial institution owned by its members. Unlike big banks, we don’t exist to make profits—we exist to serve. That means lower fees, better rates, and tools designed to actually help you thrive financially. - How long does it take to open an account?

Just a few minutes. The setup is simple, secure, and 100% online. - What if I need help?

We’ve got you covered. AlumniFi offers live support via phone and email—plus a library of resources to help you feel financially fearless. Whatever your question, we’ve got your back.Talk to a person:

Email: support@alumnifi.org

Call: (855) 955-2965

- What if I have an existing account at MSUFCU?

No problem—you can have both! There’s no need to switch or close your MSUFCU account. AlumniFi is just another way to manage your money with smart, financial tools.

1Competitor’s savings account with a 0.19% APY – $2,500 average based on the credit union national average rate, as of 06/27/25, as reflected on NCUA Credit Union and Bank Rates.